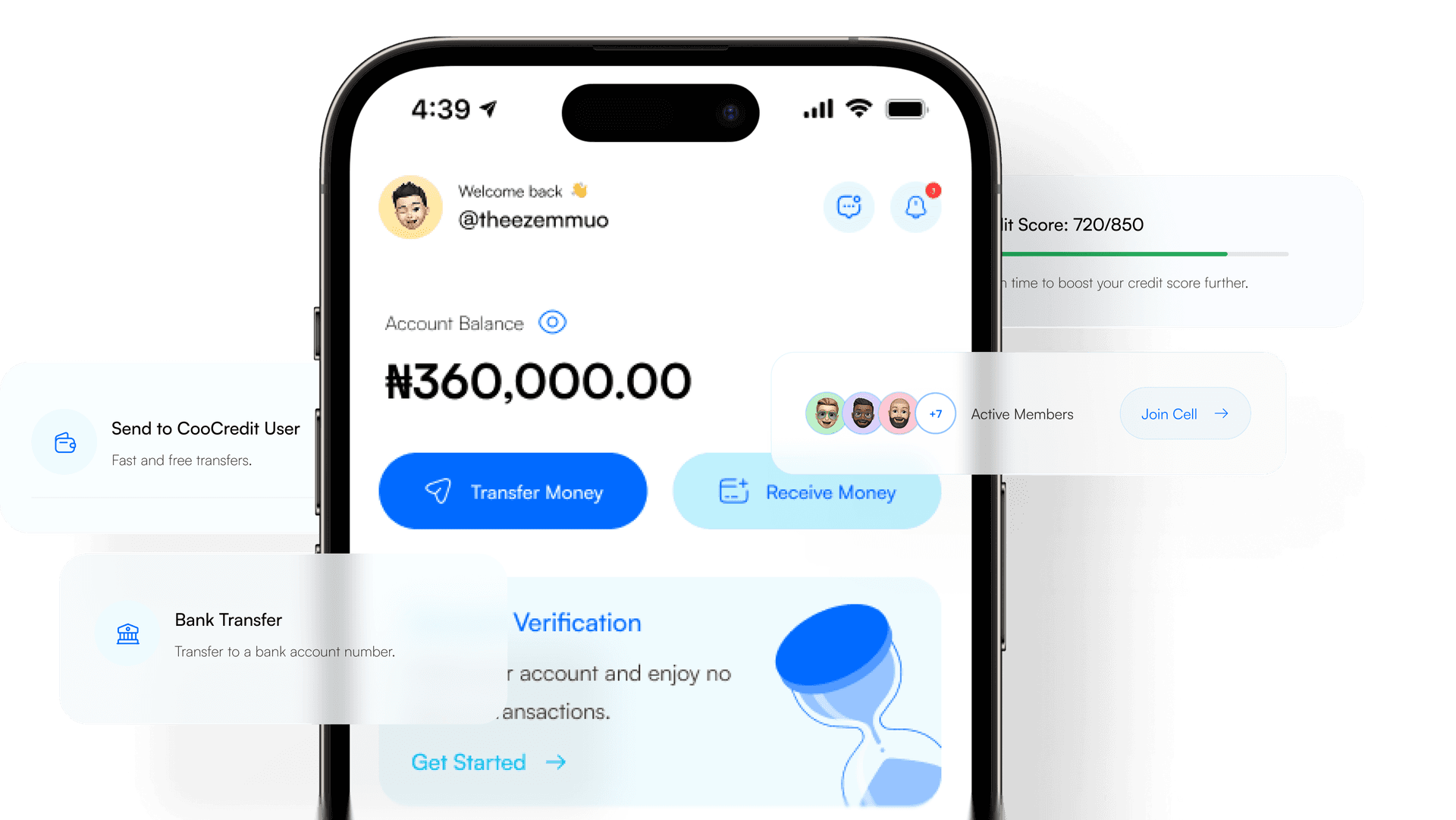

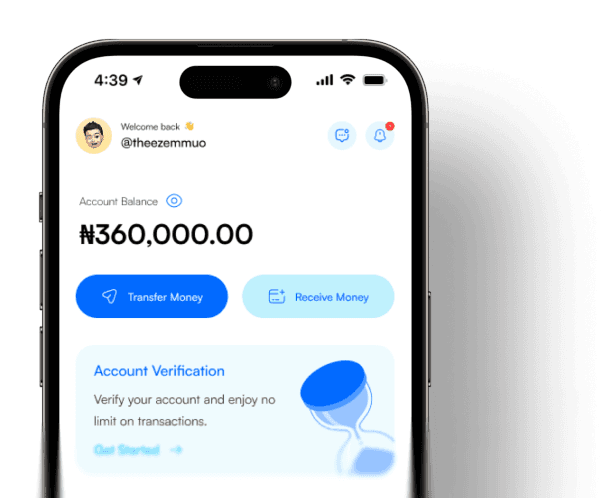

Bank, Save, and Grow your money

Your all in one secure app powered by your community.

A Digital Finance App Built for Individuals & Communities

to access smarter savings, secure transfers, and loans.

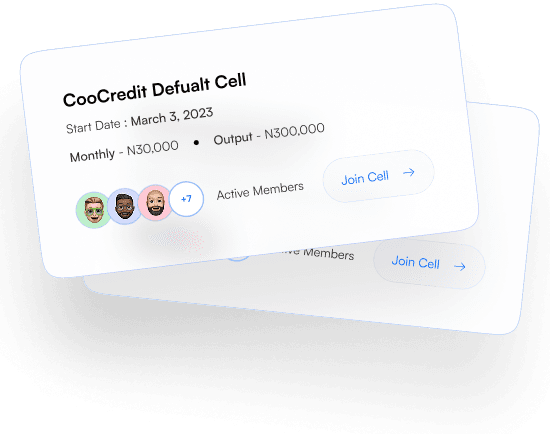

Collaborative Savings Cell

Explore collaborative savings through our Ajo-inspired cells, helping you achieve financial goals faster with friends and family.

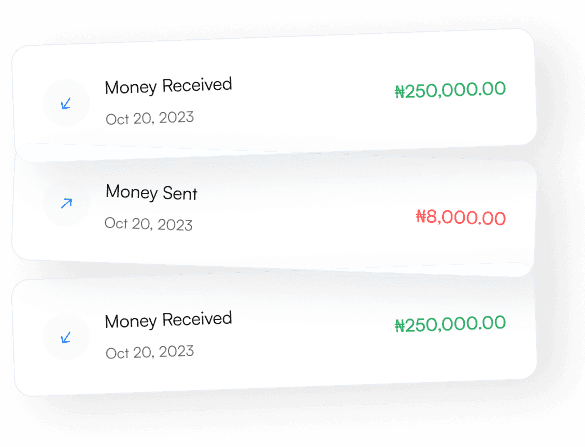

Seamless Money Transfers

Send and receive money effortlessly. With CooCredit, your transactions are instant, secure, and hassle-free.

Empowering Merchant Services

Are you a merchant? Manage saving cells, earn commissions, and access loans. Apply for POS systems and cards.

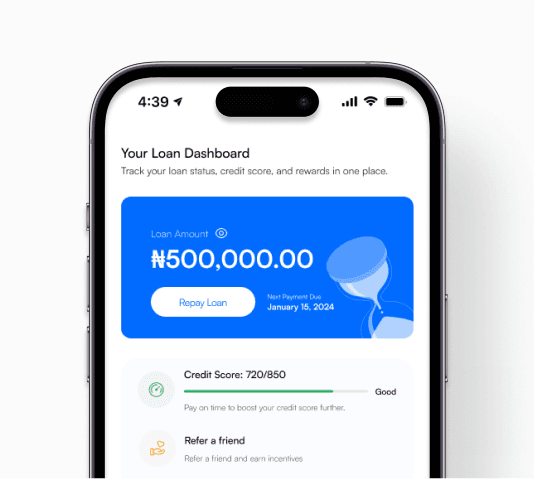

Flexible Loan Options

Need a loan? Choose payday or goal-based options with competitive rates and flexible terms.

User Convenience

Manage your finances effortlessly from the comfort of your home with our user-friendly app.

Personalized Financial Solutions

Enjoy tailored financial products that suit your unique needs and goals.

Comprehensive Support

Access 24/7 customer support and expert financial advice whenever you need it.

Secured Transactions

Rest assured knowing your financial information is protected with cutting-edge security measures.

What Our Users Are Saying

Aisha Olanipekun

Provison stall owner

I was surprised at the ease of getting loan through Coocredit. As a small business owner I needed funds to restock my inventory, and they provided me with funds within hours of applying. I recommend the app to small business owners.

Princewill Osagie

Realtor

The app is user-friendly, and the customer support team is responsive and helpful. I’ve already recommended the app to my colleagues and friends. But I think they can make their loan repayment plan more flexible to accommodate small businesses more

Adenike Afolabi

Pos vendor

The interest rates are competitive, and the loan is easily accessed, but I think they can do better with disbursement, as it took hours before my last loan was approved.

Charles Nnemeka

Digital Marketer

The application process on the app is so straightforward, the interest rate is unbelievably low and it’s better suited for cooperate workers. I will recommend the app to my colleagues at my place of work.

Suzan James

Trader

This app is a game changer for me because I was really down on stock when a friend introduced them to me. Then I downloaded the app and applied for a loan, I was surprised I got the money almost immediately. The only issue I had was the repayment not being flexible enough for me after my first payment which was a little frustrating. I called their customer support and a very polite lady picked, and after narrating my issues, ordeal she escalated and a better repayment plan was given

Aisha Olanipekun

Provison stall owner

I was surprised at the ease of getting loan through Coocredit. As a small business owner I needed funds to restock my inventory, and they provided me with funds within hours of applying. I recommend the app to small business owners.

Princewill Osagie

Realtor

The app is user-friendly, and the customer support team is responsive and helpful. I’ve already recommended the app to my colleagues and friends. But I think they can make their loan repayment plan more flexible to accommodate small businesses more

Adenike Afolabi

Pos vendor

The interest rates are competitive, and the loan is easily accessed, but I think they can do better with disbursement, as it took hours before my last loan was approved.

Charles Nnemeka

Digital Marketer

The application process on the app is so straightforward, the interest rate is unbelievably low and it’s better suited for cooperate workers. I will recommend the app to my colleagues at my place of work.

Suzan James

Trader

This app is a game changer for me because I was really down on stock when a friend introduced them to me. Then I downloaded the app and applied for a loan, I was surprised I got the money almost immediately. The only issue I had was the repayment not being flexible enough for me after my first payment which was a little frustrating. I called their customer support and a very polite lady picked, and after narrating my issues, ordeal she escalated and a better repayment plan was given

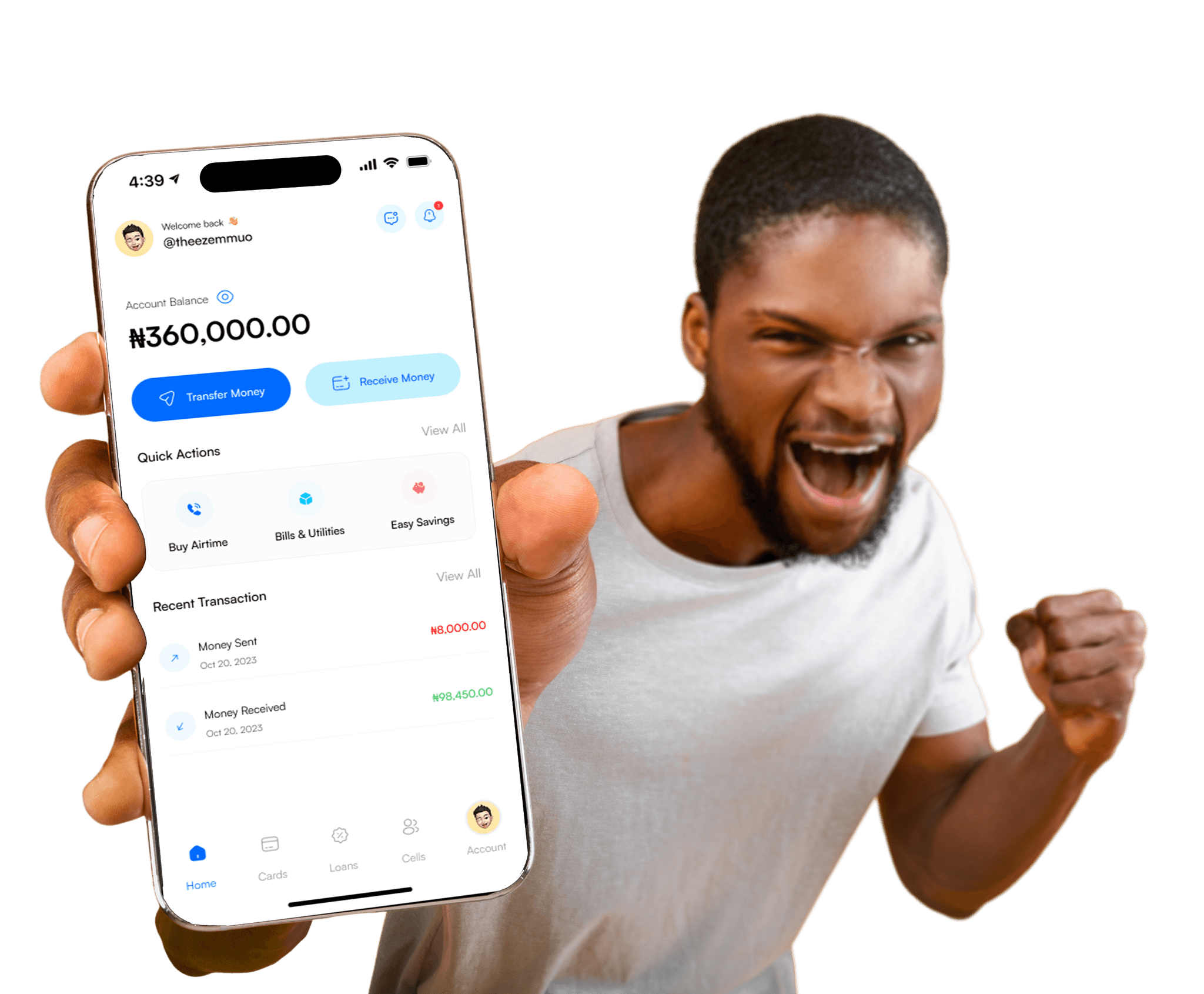

Ready to Transform Your Financial Future?

Join CooCredit today and start your journey towards financial empowerment.

Download App

Frequently Asked Questions (FAQs)

What is Coocredit?

Coocredit is a financial platform that helps individuals, market women, and small businesses save together, access affordable loans, and grow their finances. Our goal is to make savings and credit simple, accessible, and trustworthy for everyone in the community.

How do I sign up for Coocredit?

You can sign up by downloading the Coocredit app or visiting our website, creating an account with your details, and completing a quick verification. Once done, you can start saving, joining groups, or applying for loans instantly.

What is the KYC process?

The KYC process requires your full name, phone number, BVN, a valid ID, and a photo for verification. This ensures your account is secure and meets regulatory standards.

What documents are required for KYC verification?

You'll need your BVN, a valid government-issued ID (such as NIN, voter’s card, driver’s license, or international passport), and a clear photo for verification.

What is a Saving Cell?

A Saving Cell is a group of people who come together on Coocredit to contribute money regularly. It helps members save easily, build trust, and access loans through collective support.

How do I apply for a loan?

You can apply for a loan directly on the Coocredit app after completing your KYC and being an active saver. Once eligible, simply submit your loan request, and it will be reviewed for quick approval and disbursement.

How do I become a Coocredit Merchant?

To become a Coocredit Merchant, register through the Coocredit app or website, complete the merchant onboarding form, and provide your business and KYC details. Once approved, you can start offering Coocredit services to your customers.

What benefits do merchants receive?

Coocredit Merchants earn commissions on transactions, attract more customers through savings and loan services, and gain access to business support and financial tools to grow their income.